About the Project

BlocHome had built an end-to-end platform that tokenized or

fractioned economic exposure to curated residential

properties and presented those exposures as purchasable

slices. Investors created accounts, completed KYC, chose

subscription or one-off purchases, and used the secondary

billboard to trade slices; the company backed each offering

with project pages, notarial/legal references and investor

communications to align on-platform records with off-chain

legal processes. BlocHome positioned itself as an entry

point for retail investors to access property with low

minimums and managed onboarding.

Solutions: Our software agency provided

We automated notary-grade document flows and tied

on-platform holdings to legal artifacts so investor rights

were auditable and jurisdictionally compliant. We optimized

KYC with staged capture and third-party verifiers to meet

fast activation targets while lowering abandonment. We added

marketplace liquidity features (batching and incentives)

plus a defensible ROI simulator with sensitivity analysis to

improve investor confidence. Finally, we deployed CRM

automation and concierge tooling so demos, notarizations and

support scaled without large headcount increases.

Key Features of the Application

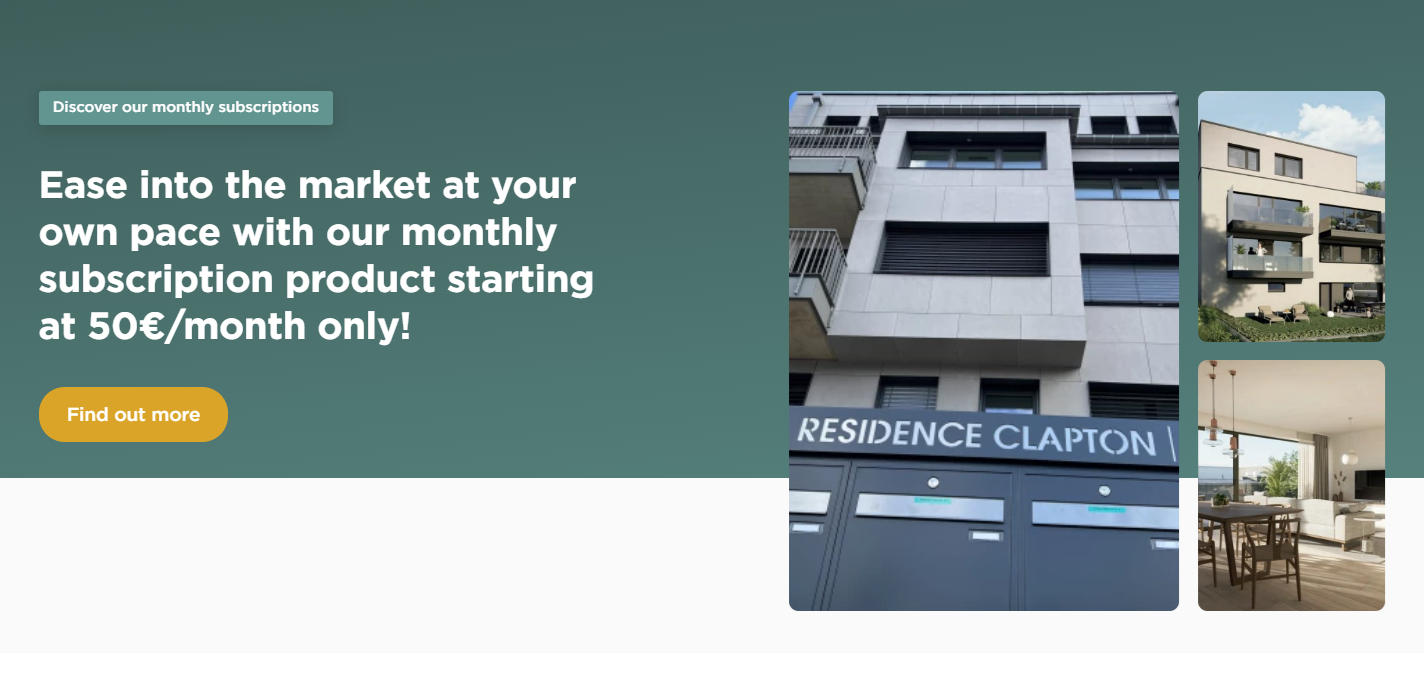

1. Monthly subscription & slice purchases

BlocHome offered monthly subscriptions (from ~€50–€100) and

one-time slice purchases so investors could build exposure

gradually.

2. Curated project portfolio

The platform listed curated property projects (e.g., Clapton

Residence in Luxembourg-Cessange) with project pages and

status details to inform investment decisions.

3. Investor onboarding & KYC

BlocHome implemented a digital account creation and KYC

workflow that verified investor accounts (they advertised

24-hour verification).

4. Secondary marketplace (“Billboard”)

The product included a secondary trading surface (the

“billboard”) where registered investors could buy and sell

ownership slices.

5. ROI simulator & analytics

BlocHome provided an ROI simulator and investment metrics so

users could model returns and track portfolio progress.

Technologies We Use in This Project

The solution improved user engagement, and a pilot adoption

rate exceeding expectations.