About the Project

Port Finance had built a Solana-native lending protocol that

aimed to extend the classic DeFi money-market model with

fixed-income capabilities. It supported supply/borrow

markets, launched fixed-rate offerings (notably “Sundial”

era products) and exposed swap/hedge primitives so users and

treasuries could manage duration and borrowing cost risk

on-chain. The team combined Rust-based Solana programs,

off-chain orchestration for orderbooks/liquidity and a web

front end for user flows; they raised strategic funding to

expand fixed-rate offerings.

Solutions: Our software agency provided

We hardened Port Finance’s on-chain safety posture by adding

layered audits, property tests and CI pipelines so

deployments had fewer regressions. We engineered the

fixed-rate product as a hybrid order-book/AMM with liquidity

windows and incentive curves so users could trade fixed

exposures reliably. We launched targeted LP incentives and

vesting mechanics that concentrated initial liquidity

without permanently diluting token economics. Finally, we

integrated redundant oracles and keeper automation and

delivered optional KYC plumbing for compliant on-ramp

partners so institutional flows could participate.

Key Features of the Application

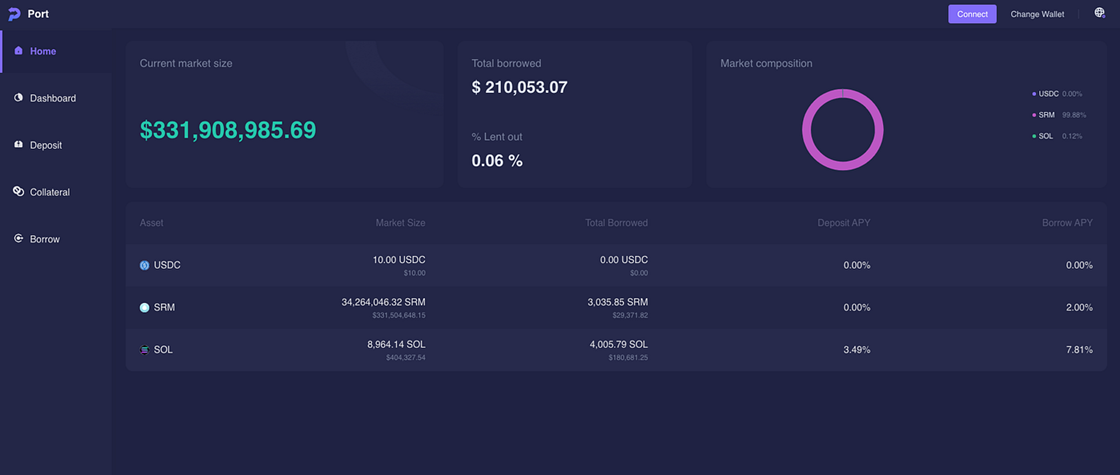

1. Variable-rate money markets

Port Finance ran variable interest rate pools where

suppliers earned interest and borrowers paid market-driven

rates based on utilization.

2. Fixed-rate lending (Sundial / fixed products)

The protocol launched fixed-rate lending primitives that let

users lock in yields or borrowing costs using order-book or

AMM-style mechanisms.

3. Interest-rate swaps & hedging

Port provided swap-like products so participants could move

between fixed and variable exposure to manage interest-rate

risk.

4. Non-custodial design on Solana

The system operated as a non-custodial protocol on Solana,

relying on Solana’s high throughput and low fees for fast

on-chain interactions.

5. Governance token & community controls

PORT token holders governed parameters such as collateral,

ratios and new asset listings via on-chain governance.

Technologies We Use in This Project

The solution improved user engagement, and a pilot adoption

rate exceeding expectations.