About the Project

QUODD builds a cloud-native, API-first market-data ecosystem

(QX Digital + QX Marketplace) that packages, normalizes and

delivers pricing, reference and fundamentals content from a

broad set of sources on demand. Institutions call the APIs

(REST or gRPC) or use bulk query endpoints and an Excel

add-in to pull live, intraday and historical data into

trading systems, valuations workflows, back-office reporting

and customer-facing apps. QUODD focuses on modular,

transparent delivery (flexible formats, clear billing) and

positions its platform as a lower-friction, enterprise-grade

alternative for firms that need tailored data footprints and

programmable access.

Solutions: Our software agency provided

We implemented resilient ingestion and streaming layers plus

caching strategies that delivered accurate, low-latency

market prices to client applications. We built normalization

microservices and enrichment pipelines so diverse data

sources presented as a single, stable API surface. We

developed high-throughput bulk query engines and Cloud

Search integrations to power both ad-hoc lookups and

scheduled back-office extracts. We added entitlement

middleware, audit trails and monitoring so data licensing

and SLAs remained transparent and auditable.

Key Features of the Application

1. Real-time & delayed pricing

QUODD delivered exchange-level and consolidated real-time

and delayed quotes across equities, ETFs and indices for

trading and display use cases.

2. Historical & end-of-day data

The platform provided intraday bars, end-of-day price

history and adjusted historical series that clients used for

valuations and back-testing.

3. Fundamentals & reference data

QUODD supplied fundamentals, financial statements, corporate

actions and instrument attributes to support reporting and

analytics.

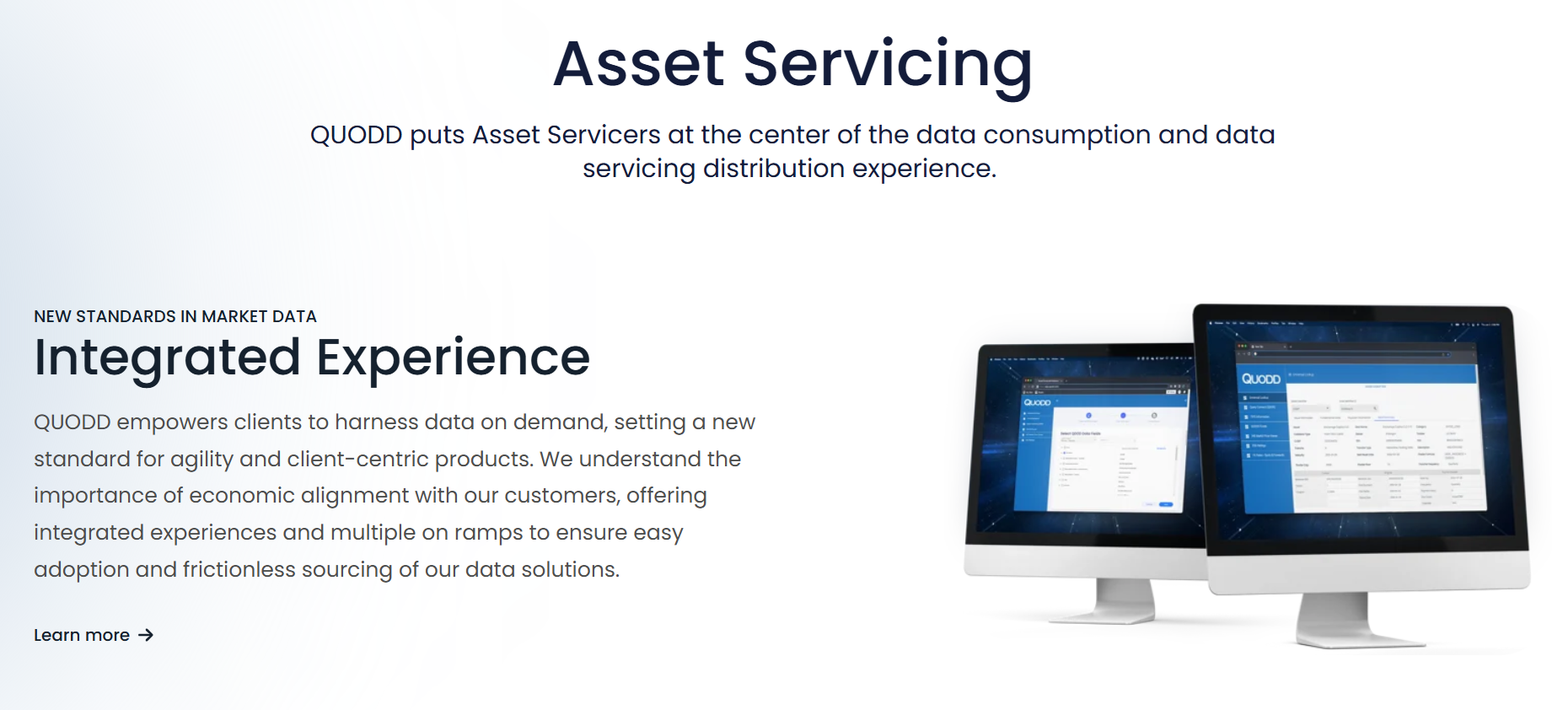

4. QX Digital & QX Marketplace

The QX Digital platform and Marketplace allowed clients to

assemble on-demand, modular data products and schedule

tailored deliveries.

5. REST/gRPC APIs & Excel add-in

QUODD exposed programmatic access via REST and gRPC

endpoints and provided an Excel add-in for analyst workflows

and bulk lookups.

6. Cloud Search & symbol resolution

The platform offered fast typeahead and symbol-resolution

services that reduced integration friction for client apps.

Technologies We Use in This Project

The solution improved user engagement, and a pilot adoption

rate exceeding expectations.