About the Project

Kyriba had built a unified Liquidity Performance Platform to

replace fragmented spreadsheets and siloed banking

connections with a single source of truth for corporate cash

and risk. The platform ingested bank and ERP feeds,

normalized transactions, enabled payment orchestration and

provided forecasting, scenario planning and hedging

workflows; it also supported working-capital programs and

exposed APIs for enterprise integrations. Over time Kyriba

invested in scale (thousands of bank connections and an

extensive payments footprint), regulatory compliance, and

newer AI features to accelerate routine treasury decisions

and fraud detection.

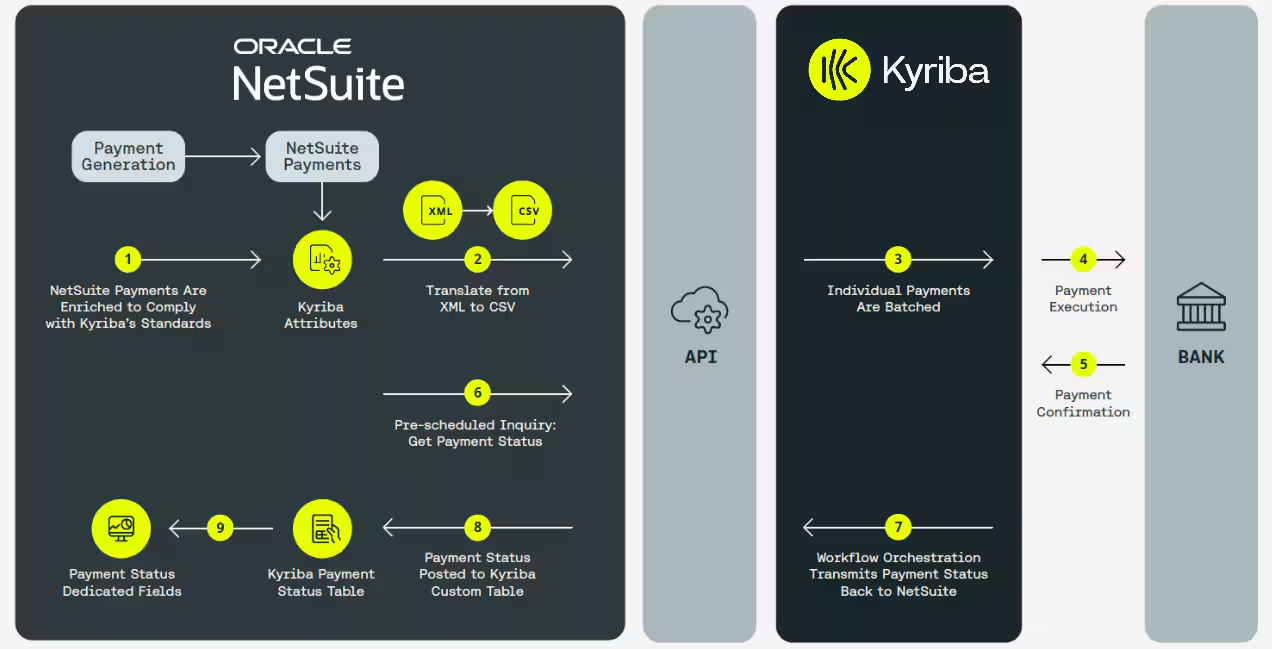

Solutions: Our software agency provided

We implemented a connector hub and schema-driven bank

adapters so Kyriba reduced onboarding time for new bank

integrations and improved data quality. We developed a

resilient streaming ingestion layer that synthesized timely

cash events and materially improved forecast feed

reliability. We hardened payment workflows with layered

security, screening and model-based anomaly detection so

high-value payments were safer and disputes fell. Finally,

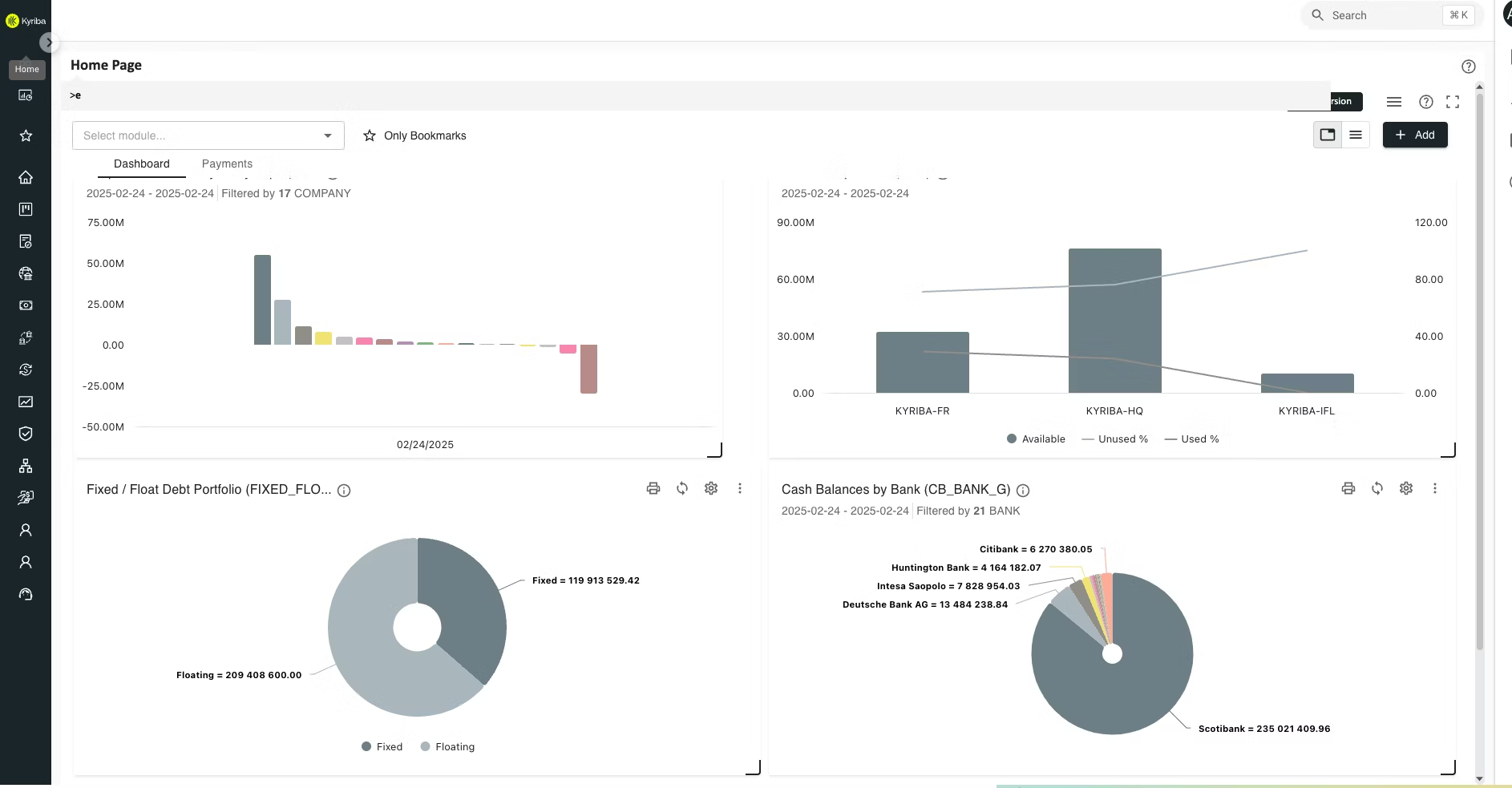

we delivered executive dashboards that tied platform

automation to measured treasury outcomes (cash accuracy,

days-sales-outstanding improvements and reduced manual

reconciliation).

Key Features of the Application

1. Cash & Liquidity Management

Kyriba centralized bank balances and cash positions to

produce accurate, rolling cash forecasts and intraday

liquidity views.

2. Payments Orchestration & Security

The platform automated and secured global payment flows,

with payment workflows, approvals and fraud-detection

controls.

3. Risk Management & FX Hedging

It provided exposure aggregation and hedging tools to manage

FX, interest-rate and commodity risk and to automate hedge

accounting.

4. Connectivity & Open APIs

Kyriba exposed an Open API hub and bank/ERP connectors to

ingest 3rd-party data and to push/pull transactions across

ecosystems.

5. Working Capital & Supply Chain Finance

The product offered receivables/payables financing options

and supplier programs to optimize working capital.

Technologies We Use in This Project

The solution improved user engagement, and a pilot adoption

rate exceeding expectations.