About the Project

Lendio had built a dual-facing fintech: a borrower

marketplace that simplified access to dozens of lending

products, and an enterprise platform that enabled banks and

fintech partners to embed lending flows or run their own

automated underwriting. Borrowers filled a single

application; Lendio’s matching engine (plus human

underwriting when needed) routed applications to appropriate

lending partners; approved funds were then arranged by the

partner lenders. Over time Lendio expanded into embedded

finance and lender technology partnerships, powering other

firms’ SBA and SMB lending experiences while scaling

marketplace volume.

Solutions: Our software agency provided

We improved Lendio’s matching by operationalizing ML

pipelines and adding explainability so lender acceptance

rates rose. We extended the LOS with configurable

underwriting flows and audit logs so multiple lenders could

automate decisioning securely. We delivered an embeddable

SDK and webhook-first integration patterns that reduced

partner integration time and increased conversion. We also

automated partner onboarding and built autoscaling

infrastructure so Lendio handled surges and maintained

performance while growing marketplace liquidity.

Key Features of the Application

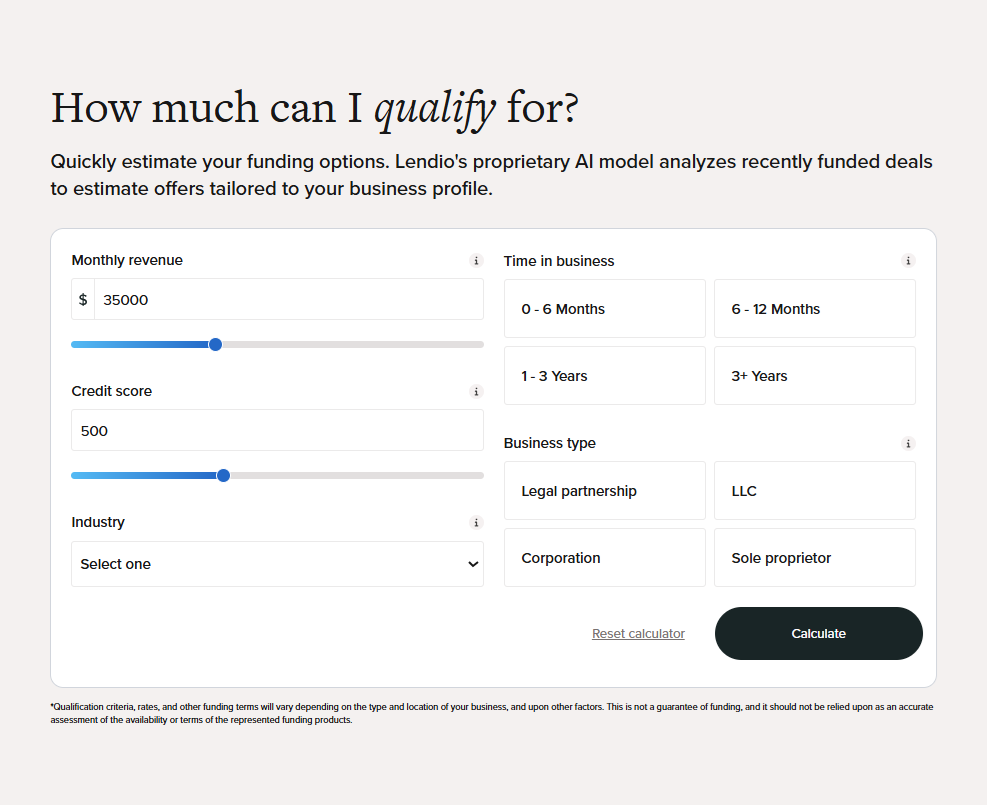

1. Marketplace & One-Application Flow

Lendio operated a centralized online marketplace that let

small businesses apply once and receive matched offers from

multiple lenders, reducing application friction.

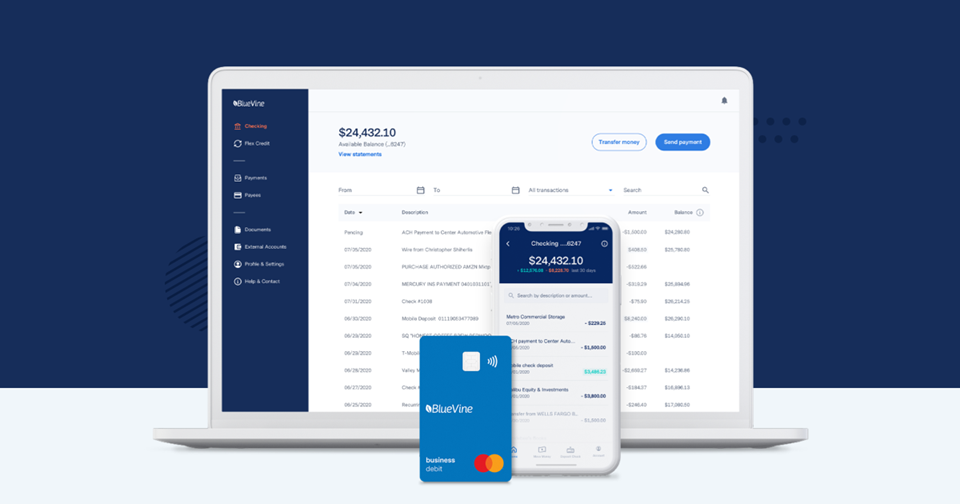

2. Embedded Marketplace for Partners

The Embedded Marketplace allowed ISVs, banks and service

providers to embed Lendio’s loan application and offer

experience directly into their own products and customer

journeys.

3. AI-driven Matching & Decisioning

Lendio used machine-learning models to match applicants to

the most suitable lenders and to reduce manual underwriting,

improving match rates and throughput.

4. Lender Technology & LOS

Lendio delivered a cloud-based lender platform (LOS) that

automated underwriting, application routing and loan

lifecycle workflows so banks and lenders could originate SMB

loans at scale.

5. Large Lender Network & Coverage

The platform worked with a network of 70–75+ lending

partners to cover many product types (term loans, SBA,

equipment finance, lines of credit).

Technologies We Use in This Project

The solution improved user engagement, and a pilot adoption

rate exceeding expectations.